The financial services sector is currently navigating a massive shift. It isn't just about managing capital anymore; it is about how effectively you manage information. Every day, retail banks, lending firms, and investment houses generate mountains of data within their CRM.

For many, Salesforce is the engine behind this operation. As a world-class Sales and Service CRM, it tracks every lead, every loan application, and every customer support ticket. However, there is a recurring problem in the industry: The Data Silo. Having data inside Salesforce is one thing. Getting your team to look at it, understand it, and act on it in real-time is another. To truly move the needle on performance, banking teams need more than just a database - they need constant, ambient visibility.

The Role of Salesforce in Modern Banking

While Salesforce offers many specialized products, the core Sales and Service CRM remains the heartbeat of financial institutions. It provides the essential framework for managing the customer lifecycle from the first phone call to the final loan disbursement.

Centralizing Customer Data

In traditional banking, data is often trapped in legacy systems or disconnected spreadsheets. Salesforce pulls this into a single view. A personal banker can see a client’s history, pending requests, and potential needs in one interface. This "single source of truth" is what allows banks to compete with agile FinTech startups.

Automating the Workflow

Efficiency in banking is often measured by "time to close" or "speed to lead." Salesforce allows teams to automate the boring stuff. Whether it’s an automated email follow-up for a mortgage inquiry or a triggered task for a compliance officer, the CRM keeps the gears turning.

AI-Driven Insights with Agentforce

The latest evolution in the Salesforce ecosystem is Agentforce. These AI agents handle routine tasks that used to eat up a banker’s afternoon. Think of them as digital assistants that can screen initial inquiries or handle basic customer service FAQs, leaving your human experts to handle complex financial planning.

The Struggle: Why High-End CRMs Often Fail to Deliver

You can spend thousands on Salesforce licenses, but the ROI only appears if your team uses the data. In the fast-paced world of finance and banking, several "human" obstacles often get in the way.

- The "Hidden Dashboard" Problem: Most financial teams are busy. Checking a Salesforce dashboard requires them to stop what they are doing, open a new tab, and log in. In reality, this rarely happens more than once a day.

- Decision Delays: When data stays hidden, decisions become reactive. If a branch is falling behind its targets, managers might not realize it until the end of the week.

- The Performance Silo: Without a shared view of success, individual team members often feel disconnected from the organization's goals.

Why Real-Time Data Visibility is a Game Changer

Data only changes behavior when it is visible. This is a psychological fact often referred to as the "Scoreboard Effect." When people can see their progress in real-time, they naturally work harder to improve the numbers.

When a team sees a live display of their current sales pipeline or the number of pending support tickets, they take collective ownership. It moves the conversation from "What did I do?" to "What are we doing right now?" This alignment reduces meeting fatigue and keeps the office focused on high-value tasks.

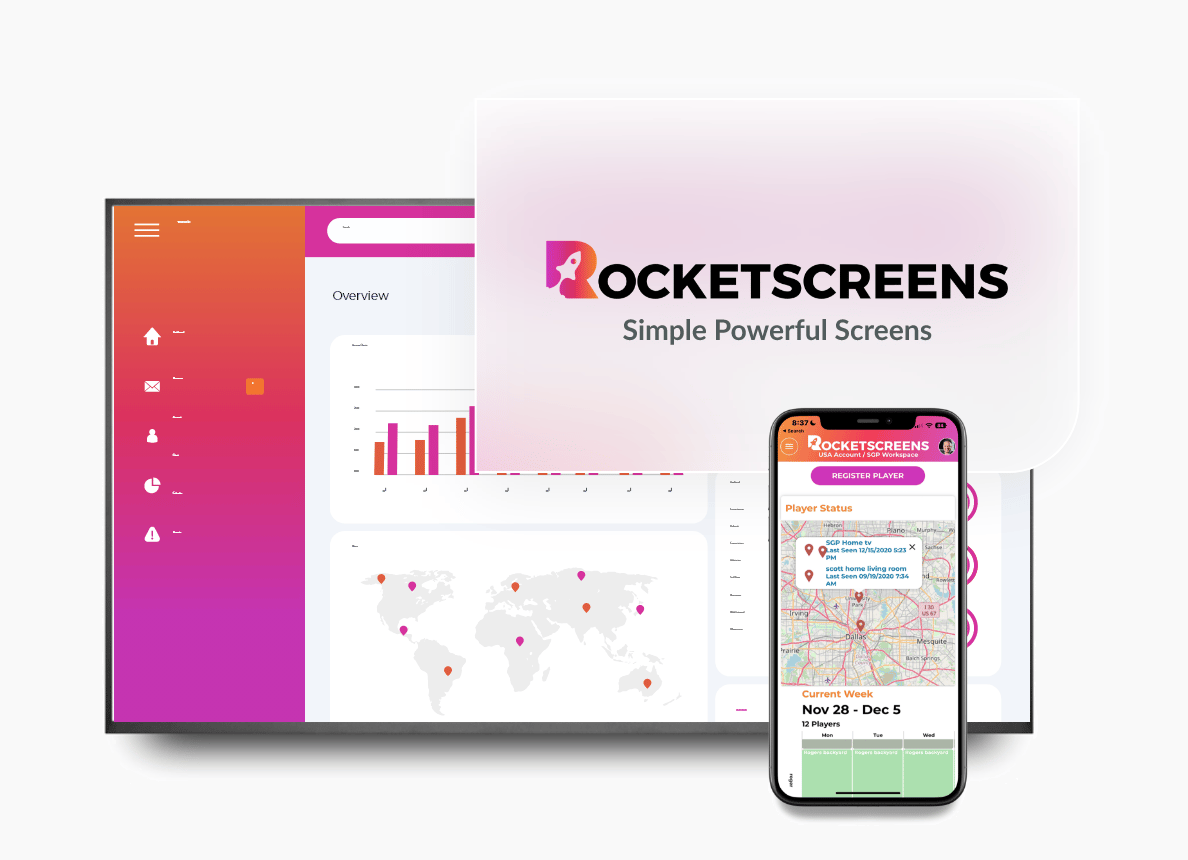

RocketScreens: Bringing Salesforce to the Big Screen

This is exactly where RocketScreens bridges the gap. We don't just "store" your data; we make it impossible to ignore. RocketScreens is a digital signage platform that allows you to take your Salesforce dashboards and push them onto physical screens throughout your office.

Our Native Salesforce Integration

We have built a native Salesforce integration specifically to solve the visibility problem. Our platform connects directly to your Sales or Service CRM, allowing you to pull live reports onto your office TVs securely.

Auto-Refreshing for Real-Time Accuracy

Banking moves fast. You can't rely on a screenshot from this morning. RocketScreens ensures your Salesforce metrics auto-refresh at the intervals you choose. As soon as a loan is marked "Approved" in Salesforce, the chart on the wall updates.

Security and Privacy

We understand that financial data is sensitive. Our integration is built with enterprise-grade security. You control exactly which parts of a dashboard are shown and which screens they appear on.

Practical Examples: Salesforce Dashboards for Banking Teams

What should you actually show on your screens? Here are three ways our customers use RocketScreens today:

- The Mortgage & Loan Funnel: Visualize new applications today, files in underwriting, and loans ready for closing.

- The Customer Service Heatmap: Track average wait times, open cases, and CSAT scores for retail branches.

- The Wealth Management Leaderboard: Keep advisors motivated by showing new AUM this month and lead-to-client conversion rates.

Real-World Impact: Faster Approvals and Better Alignment

Imagine a commercial lending team that feels constantly behind. By installing TVs showing the "Active Loan Queue" from Salesforce, the team suddenly sees exactly where 12 loans are stuck in "Document Review." Instead of waiting for a weekly meeting, the team rallies and clears the backlog by lunch. Visibility turns passive data into active results.

Get Started: Turn Your Office Into a High-Performance Hub

If your bank or financial firm is already using Salesforce, you have a wealth of information at your fingertips. Don't let that data stay hidden in a browser tab. RocketScreens makes it simple, secure, and fast to turn any TV into a powerful performance dashboard.

Ready to unlock the true value of your Salesforce data?

Start your free trial today and let’s get your data moving.

Frequently Asked Questions (FAQs)

What is Salesforce for Banking?

Most banks use the Salesforce Sales and Service CRM to manage customer relationships, track loan pipelines, and handle customer service requests.

How does RocketScreens connect to Salesforce?

RocketScreens has a native integration. You log in via our secure portal, select your dashboard, and it streams live to your office TVs.

Is it secure for a banking environment?

Yes. We use standard OAuth protocols to connect to Salesforce, and you maintain full control over what data is displayed.